Rouyn-Noranda, Quebec--(ACN Newswire - September 8, 2025) - Radisson Mining Resources Inc. (TSXV: RDS) (OTCQB: RMRDF) ("Radisson" or the "Company") is pleased to announce assay results from fifteen new drill holes completed at its 100%-owned O'Brien Gold Project ("O'Brien" or the "Project") located in the Abitibi region of Québec. The fifteen holes represent step-outs below the existing geological model, east of the historic O'Brien Gold Mine (Figure 1) and are outside the scope of the recently completed Preliminary Economic Assessment ("PEA", see Radisson news release dated July 9, 2025). All holes intersected gold mineralization in characteristic quartz-sulphide-gold veins, and thirteen of the holes returned intercepts with grades and thicknesses consistent with the Project's existing mineral resources. These results continue to expand the scope of the Project's known gold mineralization. Highlights include:

-

OB-24-363 intersected 8.41 grams per tonne ("g/t") gold ("Au") over 2.2 metres, including 14.40 g/t Au over 1.2 metres and 9.07 g/t Au over 1.8 metres, including 12.10 g/t Au over 0.9 metres;

-

OB-24-354 intersected 7.95 g/t Au over 2.30 metres, including 14.85 g/t Au over 1.0 metre;

-

OB-24-364 intersected 12.75 g/t Au over 1.4 metres and 11.15 g/t Au over 1.50 metres;

-

OB-24-361 intersected 3.50 g/t Au over 5.0 metres, including 8.96 g/t Au over 1.28 metres, and 15.10 g/t Au over 1.0 metre; and

-

OB-25-371W1 intersected 5.66 g/t Au over 3.0 metres, including 9.97 g/t Au over 1.5 metres.

Matt Manson, President & CEO, commented: "Our ongoing drilling at the O'Brien Project is focussed on "proof-of-concept" step-outs designed to test the full scope of the Project beyond previous drilling. We recently released the latest results from drilling beneath the historic O'Brien gold mine where we have been delineating multiple high-grade gold-bearing veins over a large area up to 500 metres below the base of the historic workings. Today's news release shows results from drill holes located to the east of the historic mine, and below the existing mineral resources. Of note, several of the holes represent deep step-outs below our "Trend #2", pushing the scope of known mineralization downwards by up to 300 metres in this important area. Our Exploration Target at O'Brien is between 3 and 4 million ounces of gold in 15 to 20 million tonnes at between 4.5 and 8.0 g/t Au. This is based on the proposition that O'Brien's mesothermal gold mineralization continues to an exploration horizon of 2 kilometres depth. Today's results continue to support this thesis. With the recent completion of our high-value, but "snap-shot", PEA, our focus is on aggressive exploration and resource growth. Four rigs are currently active at the Project and drilling continues."

The reader is cautioned that the potential quantity and grade of an Exploration Target is conceptual in nature, there has been insufficient exploration to define a mineral resource and that it is uncertain if further exploration will result in the target being delineated as a mineral resource.

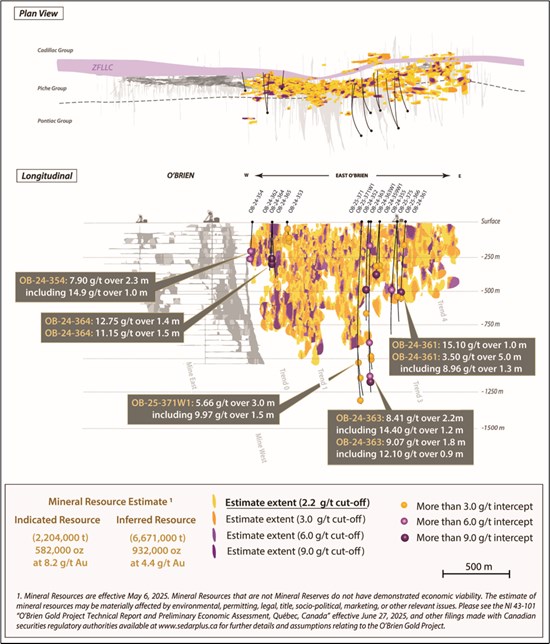

Figure 1: Long Section and Plan View of Gold Vein Mineralization and Mineral Resources at the O'Brien Gold Project, with Today's Drill Holes Illustrated

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10977/265432_bb2e887f64ce98f8_001full.jpg

Table 1: Assay Results from Drill Holes OB-24-352 to OB-25-375

| DDH |

Zone |

|

From (m) |

To (m) |

Core Length (m) |

Au g/t - Uncut |

Host Lithology |

| OB-24-352 |

Trend #2 |

|

521.0 |

522.0 |

1.00 |

13.10 |

PON-S3 |

| |

703.0 |

704.5 |

1.50 |

3.73 |

S1P |

| OB-24-353 |

Trend #1 |

|

70.0 |

71.5 |

1.50 |

3.51 |

PON-S3 |

| |

160.9 |

162.0 |

1.14 |

3.24 |

S1P |

| |

191.0 |

194.3 |

3.30 |

3.70 |

TX |

| Including |

192.0 |

193.0 |

1.00 |

6.28 |

TX |

| OB-24-354 |

Trend #0 |

|

232.0 |

234.3 |

2.3 |

7.9 |

S1P |

| Including |

232.0 |

233.0 |

1.0 |

14.9 |

S1P |

| |

302.7 |

304.0 |

1.3 |

6.4 |

V3-N |

| OB-24-355 |

Trend #3 |

|

432.4 |

433.7 |

1.30 |

3.91 |

S1P |

| |

466.8 |

468.9 |

2.10 |

3.49 |

V3-N |

| OB-24-359W1 |

Trend #3 |

|

429.3 |

430.8 |

1.50 |

3.88 |

V3-S |

| |

495.0 |

496.0 |

1.00 |

11.20 |

S3P |

| OB-24-361 |

Trend #3 |

|

195.5 |

196.5 |

1.00 |

4.46 |

PON-S3 |

| |

572.4 |

573.4 |

1.00 |

15.10 |

V3-S |

| |

633.0 |

638.0 |

5.00 |

3.50 |

V3-S |

| Including |

633.0 |

634.3 |

1.28 |

8.96 |

S1P/POR-N |

| OB-24-363 |

Trend #2 |

|

194.5 |

195.9 |

1.40 |

6.04 |

PON-S3 |

| |

910.0 |

911.0 |

1.00 |

7.65 |

PON-S3 |

| |

1,199.7 |

1,201.9 |

2.20 |

8.41 |

V3-S |

| Including |

1,200.7 |

1,201.9 |

1.20 |

14.40 |

V3-S |

| |

1,231.3 |

1,233.1 |

1.80 |

9.07 |

POR-S |

| Including |

1,232.2 |

1,233.1 |

0.90 |

12.10 |

POR-S |

| OB-25-363W1 |

Trend #2 |

|

1,037.0 |

1,038.4 |

1.40 |

4.16 |

V3-S |

| |

1,056.5 |

1,058.0 |

1.50 |

4.04 |

V3-S |

| OB-24-364 |

Trend #1 |

|

388.0 |

389.4 |

1.40 |

12.75 |

V3-CEN |

| |

402.5 |

404.0 |

1.50 |

6.26 |

S1P |

| |

413.2 |

414.7 |

1.50 |

11.15 |

POR-N |

| OB-25-366 |

Trend #2 |

|

619.0 |

620.0 |

1.00 |

3.71 |

PON-S3 |

| OB-25-371 |

Trend #2 |

|

1,402.0 |

1,404.5 |

2.50 |

3.99 |

POR-S |

| Including |

1,402.0 |

1,403.0 |

1.00 |

5.54 |

POR-N/V3-N |

| OB-25-371W1 |

Trend #2 |

|

1,058.5 |

1,061.5 |

3.00 |

5.66 |

PON-S3 |

| Including |

1,058.5 |

1,060.0 |

1.50 |

9.97 |

PON-S3 |

| |

1,210.9 |

1,214.0 |

3.10 |

3.21 |

V3-S |

| OB-25-375 |

Trend #3 |

|

538.0 |

539.5 |

1.50 |

7.38 |

S3p |

|

Notes on Calculation of Drill Intercepts:

The O'Brien Gold Project Mineral Resource Estimate effective May 6, 2025 ("MRE") utilizes a 2.20 g/t Au bottom cutoff, a US$2,000 gold price, a minimum mining width of 1.2 metres, and a 40 g/t Au upper cap on composites. Intercepts presented in Table 1 are calculated with a 3.00 g/t Au bottom cut-off. True widths, based on depth of intercept and drill hole inclination, are estimated to be 30-80% of core length. Table 2 presents additional drill intercepts calculated with a 1.00 g/t bottom cut-off over a minimum 1.0 metre core length so as to illustrate the frequency and continuity of mineralized intervals within which high-grade gold veins at O'Brien are developed. Lithology Codes: PON-S3: Pontiac Sediments; V3-S, V3-N, V3-CEN: Basalt-South, North, Central; S1P, S3P: Conglomerate; POR-S, POR-N: Porphyry South, North; TX: Crystal Tuff; ZFLLC: Larder Lake-Cadillac Fault Zone.

|

O'Brien Mineral Resource Estimates

The Mineral Resource Estimate ("MRE") utilized in the recent O'Brien PEA comprises Indicated Mineral Resources of 0.58 million ounces (2.20 million tonnes at 8.2 g/t Au) and Inferred Mineral Resources of 0.93 million ounces (6.67 million tonnes at 4.4 g/t Au)1. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. This MRE, effective as of May 6, 2025, is based on the Project's March 2023 estimate re-blocked with an updated cut-off yielding more ounces and more tonnes at a lower average grade. As such, it is based on drilling completed only to the end of 2022. By the end of the current fully funded 50-60,000 drill program, an additional 90-100,000 metres of drilling will be available for an updated estimate, including a significant meterage of drilling outside the scope of the current MRE and the recent PEA mine design.

Gold Mineralization at O'Brien

Gold mineralizing quartz-sulphide veins at O'Brien occur within a thin band of interlayered mafic volcanic rocks, conglomerates, and porphyritic andesitic sills of the Piché Group occurring in contact with the east-west oriented Larder Lake-Cadillac Break ("LLCB"). Gold, along with pyrite and arsenopyrite, is typically associated with shearing and a pervasive biotite alteration, and developed within multiple Piché Group lithologies and, occasionally, the hanging-wall Pontiac and footwall Cadillac meta-sedimentary rocks.

As mapped at the historic O'Brien mine, and now replicated in the modern drilling, individual veins are generally narrow, ranging from several centimetres up to several metres in thickness. Multiple veins occur sub-parallel to each other, as well as sub-parallel to the Piché lithologies and the LLCB. Individual veins have well-established lateral continuity, with near-vertical, high-grade shoots developed over significant lengths. Based on the historic data available, it is clear that the former mine was "high-graded", with mining focussed on a main central stope and parallel veins identified but left undeveloped.

The historic O'Brien mine produced over half a million ounces of gold from such veins and shoots at an average grade exceeding 15 g/t Au and over a vertical extent of at least 1,000 metres. Modern exploration has focussed on delineating well developed vein mineralization to the east of the historic mine, with additional high-grade shoots becoming evident in the exploration data over what has been described as a series of repeating trends ("Trend #s 0 to 5").

Step-Out Drilling at O'Brien

Since the end of 2024, Radisson has been pursuing a program of broad step-outs beneath the historic O'Brien Gold mine and the existing mineral resources designed to test the scope of mineralization at the Project. This drilling is accomplished with pilot holes followed by wedges and directional drilling to maximize drill efficiency. A particular focus has been the delineation of multiple high-grade veins beneath the historic mine workings of the O'Brien mine with a series of wedge-extensions drilled from the pilot hole OB-24-337, which intersected 242.0 g/t Au over 1.0 metre within a mineralized interval that averaged 31.24 g/t Au over 8.0 metres at approximately 1,500 metres vertical depth. Assay results from a total of 7 wedges from OB-24-337 have now been reported and up to six gold-bearing veins have been delineated over an area of approximately 250 metres (east-west) by 250 metres (vertical). These veins appear to correspond to veins mapped at the base of the historic mine at 1,000 metres deep, approximately 300 to 500 metres above the new intercepts (see Radisson news release dated July 16, 2025). Current drilling in this area is focussed on infilling with pilot holes and wedge extensions both above and below the OB-24-337 pattern of branches to test the full continuity of mineralisation from the historic mine down to 2 kilometres depth.

Step-out drilling with wedge extensions has also confirmed high-grade mineralization 170 metres below the base of the existing mineral resources at Trend #1, including pilot hole OB-24-324 which intersected 27.61 g/t Au over 6.0 metres (see Radisson news release dated October 30, 2024).

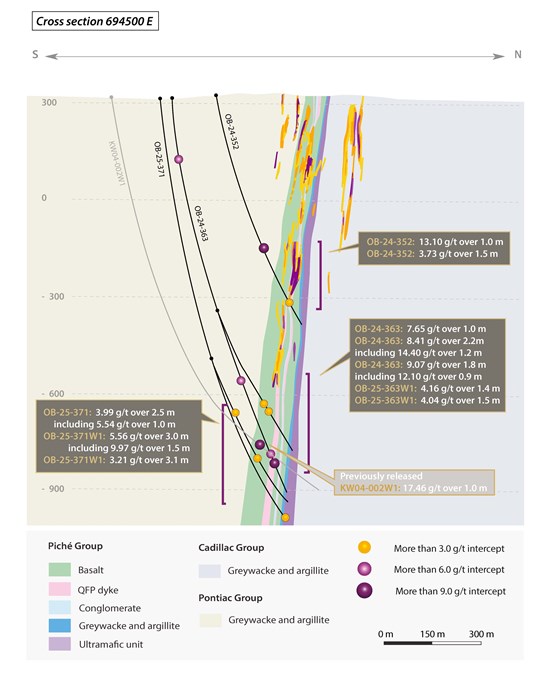

Today's results include pilot holes and wedges with high-grade mineralization located up to 300 metres below previous drill intercepts at Trend #2 and showing good continuity with the mineral resource model above (Figure 2). These drill holes include OB-24-363 which intersected 8.41 g/t Au over 2.20 metres including 14.40 g/t Au over 1.20 metres and 9.07 g/t Au over 1.80 metres including 12.10 g/t Au over 0.90 metres. Three separate drill-holes were located at or close to the base of the existing mineral resources at Trend #3, including OB-24-361 which intersected 15.10 g/t Au over 1 metre and 3.50 g/t Au over 5.0 metres including 8.96 g/t Au over 1.28 metres. These new drill intercepts extend the scope of known gold mineralization at O'Brien, which remains open to depth along the full 5 kilometre length of the property.

QA/QC

All drill cores in this campaign are NQ in size. Assays were completed on sawn half-cores, with the second half kept for future reference. The samples were analyzed using standard fire assay procedures with Atomic Absorption (AA) finish at ALS Laboratory Ltd, in Val-d'Or, Quebec. Samples yielding a grade higher than 10 g/t Au were analyzed a second time by fire assay with gravimetric finish at the same laboratory. Mineralized zones containing visible gold were analyzed with metallic sieve procedure. Standard reference materials, blank samples and duplicates were inserted prior to shipment for quality assurance and quality control (QA/QC) program.

Qualified Persons

Disclosure of a scientific or technical nature in this news release was prepared under the supervision of Mr. Richard Nieminen, P.Geo, (QC), a geological consultant for Radisson and a Qualified Person for purposes of NI 43-101. Mr. Luke Evans, M.Sc., P.Eng., ing, of SLR Consulting (Canada) Ltd., is the Qualified Person responsible for the preparation of the MRE at O'Brien. Each of Mr. Nieminen and Mr. Evans is independent of Radisson and the O'Brien Gold Project.

About Radisson Mining

Radisson is a gold exploration company focused on its 100% owned O'Brien Gold Project, located in the Bousquet-Cadillac mining camp along the world-renowned Larder-Lake-Cadillac Break in Abitibi, Québec. A July 2025 Preliminary Economic Assessment described a low cost and high value project with an 11-year mine life and significant upside potential based on the use of existing regional infrastructure. Indicated Mineral Resources are estimated at 0.58 million ounces (2.20 million tonnes at 8.2 g/t Au), with additional Inferred Mineral Resources estimated at 0.93 million ounces (6.67 million tonnes at 4.4 g/t Au). Please see the NI 43-101 "O'Brien Gold Project Technical Report and Preliminary Economic Assessment, Québec, Canada" effective June 27, 2025, and other filings made with Canadian securities regulatory authorities available at www.sedarplus.ca for further details and assumptions relating to the O'Brien Gold Project.

Figure 2: Cross Section through "Trend #2" with Drill Holes OB-24-352,363, OB-25-363W1,371 and 371W1

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10977/265432_bb2e887f64ce98f8_002full.jpg

Table 2: Detailed Assay Results (see "Notes on Calculation of Drill Intercepts")

| DDH |

Zone |

|

From (m) |

To (m) |

CorG LGngth (m) |

Au g/t - Uncut |

Host Lithology |

| OB-24-352 |

Trend #2 |

|

248.0 |

249.0 |

1.00 |

1.17 |

PON-S3 |

| |

521.0 |

522.0 |

1.00 |

13.10 |

PON-S3 |

| |

648.0 |

649.5 |

1.50 |

1.46 |

V3-S |

| |

694.7 |

697.5 |

2.80 |

1.79 |

V3-CEN |

| |

703.0 |

704.5 |

1.50 |

3.73 |

S1P |

| |

724.1 |

725.5 |

1.40 |

1.32 |

POR-S |

| OB-24-353 |

Trend #1 |

|

26.5 |

28.0 |

1.50 |

2.24 |

PON-S3 |

| |

58.7 |

61.0 |

2.30 |

2.05 |

PON-S3 |

| |

70.0 |

71.5 |

1.50 |

3.51 |

PON-S3 |

| |

134.5 |

135.9 |

1.40 |

1.90 |

V3-S |

| |

153.1 |

156.0 |

2.90 |

1.09 |

POR-S |

| |

160.9 |

162.0 |

1.14 |

3.24 |

S1P |

| |

165.5 |

166.5 |

1.00 |

1.13 |

S1P |

| |

180.9 |

181.9 |

1.04 |

1.98 |

S1P |

| |

184.4 |

185.7 |

1.29 |

1.15 |

POR-N |

| |

191.0 |

194.3 |

3.30 |

3.70 |

TX |

| Including |

192.0 |

193.0 |

1.00 |

6.28 |

TX |

| |

197.0 |

198.0 |

1.00 |

2.11 |

V3-N |

| |

203.7 |

204.5 |

0.82 |

2.30 |

V3-N |

| OB-24-354 |

Trend #0 |

|

203.0 |

203.9 |

0.90 |

1.51 |

POR-S |

| |

232.0 |

234.3 |

2.30 |

7.95 |

S1P |

| Including |

232.0 |

233.0 |

1.00 |

14.85 |

S1P |

| |

244.0 |

245.3 |

1.30 |

1.61 |

S1P |

| |

250.0 |

251.0 |

1.00 |

1.14 |

S1P |

| |

264.5 |

265.6 |

1.13 |

1.21 |

S1P |

| |

279.7 |

282.0 |

2.30 |

1.68 |

TX |

| |

302.7 |

304.0 |

1.30 |

6.39 |

V3-N |

| OB-24-355 |

Trend #3 |

|

308.6 |

309.7 |

1.10 |

1.04 |

PON-S3 |

| |

401.5 |

403.0 |

1.50 |

1.09 |

V3-S |

| |

432.4 |

437.7 |

1.59 |

1.59 |

S1P |

| Including |

432.4 |

433.7 |

1.30 |

3.91 |

S1P |

| |

440.9 |

442.0 |

1.10 |

1.87 |

V3-N |

| |

466.8 |

468.9 |

2.10 |

3.49 |

V3-N |

| |

473.2 |

474.2 |

1.00 |

1.18 |

V3-N |

| OB-24-359W1 |

Trend #3 |

|

429.3 |

430.8 |

1.50 |

3.88 |

V3-S |

| |

465.3 |

466.3 |

1.00 |

1.69 |

S1P |

| |

495.0 |

496.0 |

1.00 |

11.20 |

S3P |

| OB-24-361 |

Trend #3 |

|

195.5 |

196.5 |

1.00 |

4.46 |

PON-S3 |

| |

215.5 |

216.5 |

1.00 |

2.01 |

PON-S4 |

| |

413.0 |

414.1 |

1.10 |

1.34 |

PON-S5 |

| |

481.5 |

483.0 |

1.50 |

1.05 |

PON-S6 |

| |

514.0 |

515.5 |

1.50 |

1.09 |

V3-S |

| |

572.4 |

573.4 |

1.00 |

15.10 |

V3-S |

| |

633.0 |

638.0 |

5.00 |

3.50 |

V3-S |

| Including |

633.0 |

634.3 |

1.28 |

8.96 |

S1P/POR-N |

| |

639.0 |

642.3 |

3.30 |

1.43 |

S1P |

| OB-24-362 |

Trend #1 |

|

432.2 |

433.5 |

1.25 |

2.16 |

POR-N |

| |

444.5 |

446.0 |

1.50 |

1.70 |

TX |

| OB-24-363 |

Trend #2 |

|

194.5 |

195.9 |

1.40 |

6.04 |

PON-S3 |

| |

907.7 |

909.0 |

1.30 |

1.03 |

PON-S3 |

| |

910.0 |

911.0 |

1.00 |

7.65 |

PON-S3 |

| |

1,199.7 |

1,201.9 |

2.20 |

8.41 |

V3-S |

| Including |

1,200.7 |

1,201.9 |

1.20 |

14.40 |

V3-S |

| |

1,215.2 |

1,216.4 |

1.20 |

1.42 |

V3-S |

| |

1,231.3 |

1,233.1 |

1.80 |

9.07 |

POR-S |

| Including |

1,232.2 |

1,233.1 |

0.90 |

12.10 |

POR-S |

| |

1,286.5 |

1,287.5 |

1.00 |

2.91 |

V3-N |

| OB-25-363W1 |

Trend #2 |

|

877.0 |

878.3 |

1.30 |

1.43 |

TX |

| |

910.6 |

912.1 |

1.50 |

1.59 |

PON-S3 |

| |

1,034.0 |

1,035.0 |

1.00 |

1.02 |

PON-S3 |

| |

1,037.0 |

1,038.4 |

1.40 |

4.16 |

V3-S |

| |

1,042.6 |

1,044.0 |

1.40 |

1.93 |

V3-S |

| |

1,045.7 |

1,046.7 |

1.00 |

2.17 |

V3-S |

| |

1,052.6 |

1,059.3 |

6.70 |

1.78 |

V3-S |

| Including |

1,056.5 |

1,058.0 |

1.50 |

4.04 |

V3-S |

| |

1,186.0 |

1,187.5 |

1.50 |

2.10 |

V3-S |

| OB-24-364 |

Trend #1 |

|

164.0 |

165.5 |

1.50 |

1.41 |

PON-S3 |

| |

371.0 |

376.5 |

5.50 |

1.01 |

POR-S |

| |

388.0 |

389.4 |

1.40 |

12.75 |

V3-CEN |

| |

402.5 |

404.0 |

1.50 |

6.26 |

S1P |

| |

408.5 |

409.9 |

1.40 |

1.40 |

S1P |

| |

413.2 |

414.7 |

1.50 |

11.15 |

POR-N |

| |

440.7 |

442.0 |

1.30 |

2.32 |

V3-N |

| OB-25-365 |

Trend #1 |

|

379.0 |

380.5 |

1.50 |

1.40 |

V3-S |

| |

428.5 |

429.7 |

1.20 |

2.85 |

POR-S |

| |

469.0 |

473.5 |

4.50 |

1.28 |

POR-N |

| |

502.5 |

504.0 |

1.50 |

1.35 |

S3p |

| OB-25-366 |

Trend #3 |

|

601.0 |

602.5 |

1.50 |

1.34 |

PON-S3 |

| |

619.0 |

620.0 |

1.00 |

3.71 |

PON-S3 |

| |

811.9 |

818.1 |

6.25 |

1.21 |

V3-CEN/S1p/POR-N |

| OB-25-371 |

Trend #2 |

|

1,306.0 |

1,307.5 |

1.50 |

1.86 |

V3-N |

| |

1,310.5 |

1,312.0 |

1.50 |

1.36 |

S3p |

| |

1,326.0 |

1,327.0 |

1.00 |

1.48 |

V3-S |

| |

1,335.0 |

1,338.0 |

3.00 |

1.67 |

V3-S |

| |

1,370.5 |

1,375.2 |

4.70 |

1.07 |

POR-S |

| |

1,402.0 |

1,404.5 |

2.50 |

3.99 |

POR-S |

| Including |

1,402.0 |

1,403.0 |

1.00 |

5.54 |

POR-N/V3-N |

| |

1,405.5 |

1,406.5 |

1.00 |

1.14 |

S3p |

| OB-25-371W1 |

Trend #2 |

|

1,058.5 |

1,061.5 |

3.00 |

5.66 |

PON-S3 |

| Including |

1,058.5 |

1,060.0 |

1.50 |

9.97 |

PON-S3 |

| |

1,210.9 |

1,214.0 |

3.10 |

3.21 |

V3-S |

| |

1,216.0 |

1,218.5 |

2.50 |

1.86 |

V3-S |

| |

1,265.5 |

1,267.0 |

1.50 |

2.52 |

V3-S |

| |

1,272.7 |

1,274.2 |

1.50 |

1.08 |

V3-S |

| |

1,287.5 |

1,298.0 |

10.50 |

1.29 |

POR-S |

| |

1,323.0 |

1,324.5 |

1.50 |

1.45 |

S1p |

| |

1,327.6 |

1,328.7 |

1.10 |

2.41 |

POR-N |

| |

1,366.5 |

1,368.0 |

1.50 |

1.14 |

ZFLLC |

| OB-25-375 |

Trend #3 |

|

538.0 |

539.5 |

1.50 |

7.38 |

S3p |

| |

675.0 |

676.0 |

1.00 |

1.56 |

S3p |

| |

754.0 |

755.5 |

1.50 |

1.25 |

PON-S3 |

| |

876.5 |

878.0 |

1.50 |

2.41 |

PON-S3 |

| |

882.5 |

886.0 |

3.50 |

1.36 |

V3-S |

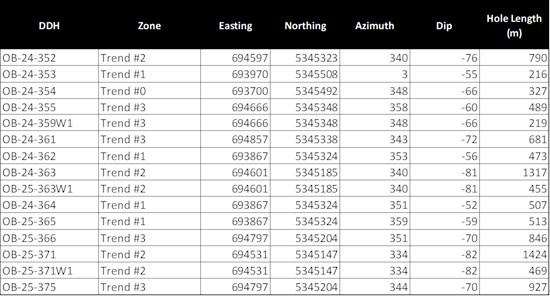

Table 3: Drill Hole Collar Information for Holes contained in this News Release

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10977/265432_a2bf4d99d4dc3aa5_007full.jpg

Notes:

Hole lengths for wedges represent meterage from point of wedge.

For more information on Radisson, visit our website at www.radissonmining.com or contact:

Forward-Looking Statements

This news release contains "forward-looking information" within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections, and interpretations as at the date of this news release. Forward-looking statements including, but are not limited to, statements with respect to the ability to execute the Company's plans relating to the O'Brien Gold Project as set out in the Preliminary Economic Assessment; the Company's ability to complete its planned exploration and development programs; the absence of adverse conditions at the O'Brien Gold Project; the absence of unforeseen operational delays; the absence of material delays in obtaining necessary permits; the price of gold remaining at levels that render the O'Brien Gold Project profitable; the Company's ability to continue raising necessary capital to finance its operations; the ability to realize on the mineral resource and mineral reserve estimates; assumptions regarding present and future business strategies, local and global geopolitical and economic conditions and the environment in which the Company operates and will operate in the future;, planned and ongoing drilling, the significance of drill results, the ability to continue drilling, the impact of drilling on the definition of any resource, and the ability to incorporate new drilling in an updated technical report and resource modelling; the Company's ability to grow the O'Brien Gold Project; the ability to negotiate and execute an arrangement with IAMGOLD related to the Doyon Mill on satisfactory terms or at all; and the ability to convert inferred mineral resources to indicated mineral resources.

Any statement that involves discussions with respect to predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "interpreted", "management's view", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information. Except for statements of historical fact relating to the Company, certain information contained herein constitutes forward-looking statements Forward-looking information is based on estimates of management of the Company, at the time it was made, involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the companies to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Such factors include, among others; the risk that the O'Brien Gold Project will never reach the production stage (including due to a lack of financing); the Company's capital requirements and access to funding; changes in legislation, regulations and accounting standards to which the Company is subject, including environmental, health and safety standards, and the impact of such legislation, regulations and standards on the Company's activities; price volatility and availability of commodities; instability in the global financial system; the effects of high inflation, such as higher commodity prices; the risk of any future litigation against the Company; changes in project parameters and/or economic assessments as plans continue to be refined; the risk that actual costs may exceed estimated costs; geological, mining and exploration technical problems; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing; risks relating to the drill results at O'Brien; the significance of drill results; and the ability of drill results to accurately predict mineralization. Although the forward-looking information contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions, the parties cannot assure shareholders and prospective purchasers of securities that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither the Company nor any other person assumes responsibility for the accuracy and completeness of any such forward-looking information. The Company believes that this forward-looking information is based on reasonable assumptions, but no assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this press release should not be unduly relied upon. The Company does not undertake, and assumes no obligation, to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law. These statements speak only as of the date of this news release.

Please refer to the "Risks and Uncertainties Related to Exploration" and the "Risks Related to Financing and Development" sections of the Company's Management's Discussion and Analysis dated April 29, 2025 for the years ended December 31, 2024, and the Company's Management's Discussion and Analysis dated August 27, 2025 for the three-months ended June 30, 2025, all of which are available electronically on SEDAR+ at www.sedarplus.ca. All forward-looking statements contained in this press release are expressly qualified by this cautionary statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

________________________

1 NI 43-101 "O'Brien Gold Project Technical Report and Preliminary Economic Assessment, Québec, Canada" effective June 27, 2025.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/265432

Topic: Press release summary

Source: Radisson Mining Resources

Sectors: Metals & Mining

http://www.acnnewswire.com

From the Asia Corporate News Network

Copyright © 2026 ACN Newswire. All rights reserved. A division of Asia Corporate News Network.

|