|

| Friday, 12 August 2016, 11:27 HKT/SGT | |

| |  | |

Source: Fujitsu Ltd | |

|

|

|

|

| Initiative for electronic invoicing and payment, and automated accounts receivable reconciliation services seeks to dramatically streamline corporate accounting processes. |

TOKYO, Aug 12, 2016 - (JCN Newswire) - Mizuho Bank, Ltd. and Fujitsu Limited today announced that they have launched a field trial aimed at providing electronic invoicing and payment and automated accounts receivable reconciliation services using electronic invoicing (EIPP)(1) and financial EDI(2). The field trial is based on an agreement, signed by the two companies on July 29, to investigate invoice and payment digitization and accounts receivable reconciliation automation services.

| | Figure 1: Model-based air-conditioner control system. |

Background

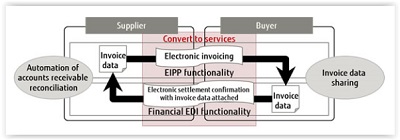

Recently, the movement toward FinTech - the fusion of finance and IT - has been accelerating both in and outside Japan. One aspect of this is financial EDI, in which information related to business transactions is attached to electronic settlement confirmations (wire transfer data), then exchanged and shared. Financial EDI is expected to offer a variety of benefits, including automated and more efficient transactions. Given this, the two companies have considered links with a shift to XML telegrams for domestic payment instructions between companies(3) being advanced by the financial services and manufacturing industries, and have begun an initiative to build a pilot system aimed at providing the type of services shown in the figure below, and to verify its impact.

Overview of the Field Trial

1. Goal

The field trial aims to digitize all transactions from invoice to payment and receipt, and to dramatically improve automation of accounts receivable reconciliation for companies by implementing EIPP and financial EDI in the invoice and payments processes of business transactions.

2.Trial period

Pilot system construction: July 2016 - October 2016 (Planned)

Effectiveness verification: November 2016 - March 2017 (Planned)

- Planned to be implemented in transactions between Fujitsu and various Fujitsu Group companies (in Japan only)

3. Content

This field trial will examine the system's effectiveness and business potential with regard to the following:

- Process optimization and cost reduction

- Enhancement of internal controls and acceleration of settlements

Future Developments

- Through this field trial, the two companies will work to develop advanced settlement services that lead to efficiencies in corporate accounting processes, to promote the creation of new businesses and convenient services using ICT.

- The two companies aim to provide services that support a shift to XML telegrams for domestic payment instructions between companies, which is being considered within the financial and industrial sectors.

- The two companies are studying the feasibility of creating a possible common environment that could also improve back-office productivity and enable business process outsourcing of credit management tasks for companies.

(1) EIPP

Electronic Invoice Presentment and Payment.

(2) EDI

Electronic Data Interchange. A system to unify information relating to business transactions into a standard format and exchange it electronically between companies.

(3) A shift to XML telegrams for domestic payment instructions between companies

In December 2015, the Japanese Financial Services Agency and Financial System Council suggested, with regard to the messaging format used in domestic payment instructions between companies, that the current "fixed length telegrams" be eliminated by 2020, and that companies migrate to XML telegrams, which offers superior information volume and data compatibility. For details, please see the Financial System Council's Report by the Working Group on Payment and Transaction Banking. (http://www.fsa.go.jp/en/refer/councils/singie_kinyu/20160621-2.html)

Contact:

Fujitsu Limited

Public and Investor Relations

Tel: +81-3-3215-5259

URL: www.fujitsu.com/global/news/contacts/

Topic: Press release summary

Source: Fujitsu Ltd

Sectors: Enterprise IT, IT Individual, Banking & Insurance

http://www.acnnewswire.com

From the Asia Corporate News Network

Copyright © 2026 ACN Newswire. All rights reserved. A division of Asia Corporate News Network.

|

|

|

|