Seoul, Korea, Feb 11, 2022 - (ACN Newswire) - Recently, Tower Finance is proud to announce the Launch of its Algorithmic Stablecoin. Algorithm-based stablecoins are new variants of cryptocurrency tailored for offering improved price stability. In the current market today, more and more users have taken interest, as it can also help in balancing the supply and demand of the asset in circulation.

Algorithmic Stablecoin Protocol, developed by Tower Finance, looks to offer considerably improved capital efficiency in comparison to collateralized stablecoins.

What is Tower Finance?

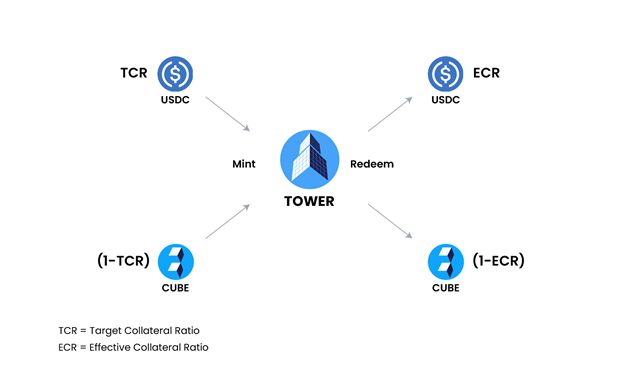

The Tower Finance is a Fractional-Algorithmic Stablecoin, soft-pegged to the U.S. Dollar, built on the Polygon network. The protocol plans to maintain TWR price stability by storing sufficient collateral in the time locked-smart contracts. The USDC is deposited into the protocol when a user mints TWR token, while the CUBE token, which is used for minting, is burned. When the user redeems TWR tokens, the protocol pays back USDC and mints the required amount of CUBE tokens. This allows arbitrageurs to help maintain price stability.

Aiming to solve the 'Stablecoin trilemma'

Tower Finance aims to provide a solution for the so-called 'Stablecoin trilemma' of decentralization, capital efficiency, and price stability by introducing TWR, its fractional-collateralized algorithmic stablecoin. Tower Finance aims to build an ecosystem that incorporates both collateral and high capital efficiency, hence developing stability.

By implementing a floating collateralization ratio, TWR not only maintains its peg in the most efficient manner possible, but it also captures value for CUBE holders and produces yield for its community of holders.

Implementing DeFi 2.0 through Protocol Owned Liquidity and Protocol Rented Liquidity

Tower Finance is the first algorithmic stablecoin protocol to adopt the 'Protocol Owned Liquidity' model introduced by OlympusDAO. While the structure is different, the underlying idea is similar. The protocol charges a penalty to users who terminate the vesting terms for the farming rewards. When this happens, the protocol uses 2/3 of the collected penalty for providing liquidity. Half of it is converted to USDC and used to provide liquidity. The leftover, which amounts to 1/3 of the collected penalty, is sent to the Profit Manager.

When TWR is minted with USDC and CUBE, the protocol doesn't immediately burn CUBE. Instead, 50% of CUBE is sold to temporarily create a CUBE-USDC LP to provide additional liquidity. We call this 'Protocol Rented Liquidity', because the meant-to-be-burnt tokens are borrowed for a short period of time to add liquidity to Tower's ecosystem until it is removed via governance decisions, in which case, the USDC is converted into CUBE and burned.

With a commitment for long-term sustainability yet a market fit, ultra high-yield/yield enhancement go-to-market strategy, it is perfectly destined to pave the way for stablecoin protocols in the era of DeFi 2.0

Tower Finance officially launches on Valentine's Day: 14th of Feb, 6:00am UTC.

https://medium.com/@tower_finance/calling-all-towerians-the-time-has-come-2fa7fe9a24fc

Social Links

Twitter: https://twitter.com/tower_finance

Discord: https://discord.com/invite/KVTe6hRZK8

Medium: https://medium.com/@tower_finance

Github: https://github.com/towerfinance

Media Contact

Brand: Tower Finance

Contact Jeremy Parker, Head of Marketing

E-mail: jeremy@towerfinance.io

Website: https://towerfinance.io/

SOURCE: Tower Finance

Topic: Press release summary

Source: Tower Finance

http://www.acnnewswire.com

From the Asia Corporate News Network

Copyright © 2025 ACN Newswire. All rights reserved. A division of Asia Corporate News Network.

|