|

| Friday, 25 February 2022, 18:00 HKT/SGT | |

| |  | |

Source: Hektar REIT | |

|

|

|

|

- Achieved Revenue of RM96.6 million & Net Property Income of RM47 million

- DPU of 2.53 sen, up 181%

- Signs of recovery weighed by Omicron surge

- Stepping up on sustainability measures & 3-star ESG rating by FTSE Russell |

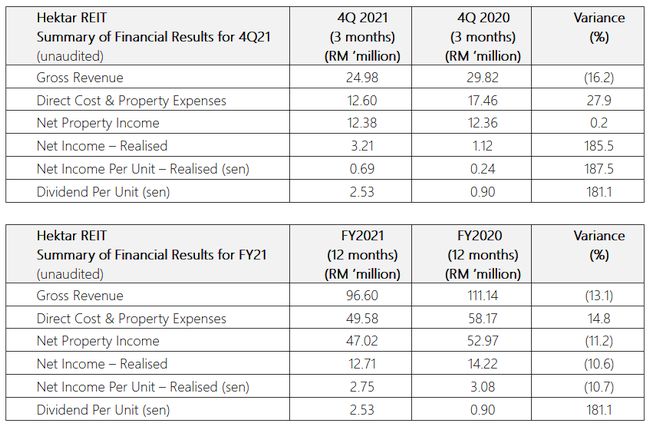

KUALA LUMPUR, Feb 25, 2022 - (ACN Newswire) - Hektar Asset Management Sdn. Bhd., the Manager of Hektar Real Estate Investment Trust ("Hektar REIT"), today announced Hektar REIT's annual results for the financial year ended 31 December 2021 ("FY2021") with revenue at RM96.60 million in FY2021, down by 13.1% compared to the same period in the preceding year. Property Operating Expenses reduced by RM8.59 million or savings of 14.8% compared to the previous year. Net Property Income (NPI) was reported at RM47.02 million, a decline of 11.2% compared with 2020. FY21 was a challenging year for the retail sector due to the COVID-19 pandemic and implementation of various Movement Control Orders, National Recovery Plan, mobility restrictions & closure of non-essential businesses for an extended period. Despite these challenges to the malls, the REIT managed to attract new & secured existing tenants covering 39.2% of Hektar REIT's Net Lettable Area ("NLA") in FY21.

| |

| | One of Hektar REIT’s regional malls, Mahkota Parade, Melaka |

For the fourth quarter ended 31 December 2021 ("4Q 2021"), Hektar REIT recorded revenue of RM24.98 million, which is 16.2% lower compared to the same quarter of the preceding year. Property Operating Expenses reduced by RM4.86 million or savings of 27.9% compared to the same quarter in the previous year. Hektar REIT registered net property income of RM12.38 million for the quarter under review, which is a slight increase of 0.2% compared to the corresponding quarter of the previous year, while realised income for 4Q 2021 was 185.5% higher at RM3.21 million compared to the RM1.12 million recorded in 4Q 2020.

The Manager noted that there are signs of recovery supported by the gradual reopening of the economy and it can also be seen in the steady rise in visitor footfall since the relaxation of restrictions by the Government. While Hektar REIT is cognisant of the economy's improved growth trajectory supported by a recovering labour market, continued policy support and expansion in external demand, as well as the possible opening of international borders as early as the second quarter, the REIT is nevertheless retaining its cautious outlook in the face of the current wave of infections stemming from the Omicron strain.

Income Distribution

As earlier announced, Hektar REIT declared an income distribution of RM11.9 million for 4Q 2021, equivalent to 2.53 sen per unit or a DPU yield of 4.96%, which is 181% higher compared to the income distribution for the corresponding period in 2020. The COVID-19 pandemic has impacted the retail industry significantly and the REIT has also not been spared. However, we remain committed to steering our portfolio into recovery this year, barring any unforeseen circumstances despite future Variants of Concern ("VOC") that might disrupt the overall recovery of the retail & economic sector.

Private Placement

During the quarter under review, Hektar REIT's fund size increased to 471,260,178 units from 461,960,178 units arising from the private placement exercise announced on 15 November 2021. A total of 9.30 million units out of the total proposed private placement of 23.098 million units were subsequently placed out in two tranches in December 2021, raising RM4.23 million. The private placement was undertaken to raise funding for working capital and capital work in progress, facilitating Hektar REIT's day-to-day operations as a whole by providing more flexibility in terms of cash flow management.

Sustainability Efforts

Hektar REIT remains committed to fulfill its obligation to ensure that all business activities are performed to high standards of Environmental, Social and Governance (ESG). Various energy utilisation and optimisation initiatives since 2017 have been put in place for all of its shopping malls, resulting in a significant reduction in greenhouse gas emissions (recorded as CO2e) and energy usage over the last five years. Despite the pandemic, reducing the environmental footprint of our assets and operations remain a priority. We managed to reduce the overall amount of CO2e emissions of our assets by about 11.6% to 18.8 million kgCO2e in 2021 from almost 21.3 million kgCO2e in 2020. Emissions intensity of our assets expressed as the amount of CO2e emitted per gross floor area (kgCO2e/sq.ft.) also improved to 4.0 kgCO2e/sq.ft. from 4.50 kgCO2e/sq.ft. in 2020. Overall, the portfolio's Building Energy Intensity ("BEI") is also on a declining trend. Hektar REIT is a constituent member of the FTSE4Good Bursa Malaysia Index and in its latest December 2021 evaluation, its ESG conduct has been recognised with a 3-star ESG rating by FTSE Russell.

For further information, please log on to www.bursamalaysia.com.

Topic: Press release summary

Source: Hektar REIT

Sectors: Daily Finance, Real Estate & REIT, Local Biz

http://www.acnnewswire.com

From the Asia Corporate News Network

Copyright © 2026 ACN Newswire. All rights reserved. A division of Asia Corporate News Network.

|

|

|

|

|

|

|

| Hektar REIT |

| Aug 25, 2024 22:15 HKT/SGT |

|

Hektar REIT's Q2 Realised Net Income Up 42.8% Backed by Enlarged and Diversified Asset Portfolio |

| Feb 29, 2024 17:00 HKT/SGT |

|

HEKTAR REIT Receives Two Inaugural Honors at Malaysia Top Achievers 2023 Award |

| Nov 30, 2023 17:00 HKT/SGT |

|

Hektar REIT and University of Reading Malaysia Forge Transformative Partnership for Educational Excellence and Community Development |

| Nov 23, 2023 09:30 HKT/SGT |

|

Hektar REIT Achieves High Occupancy & Positive Reversions |

| Nov 7, 2023 14:00 HKT/SGT |

|

Hektar REIT Achieves Historic Success: ESG Performance Rewarded with Dual Gold Accolades at The Edge Malaysia ESG Awards 2023 |

| July 27, 2023 15:34 HKT/SGT |

|

Hektar REIT's Sustainability & CSR Commitment Honored with an Accolade |

| May 25, 2023 22:00 HKT/SGT |

|

Hektar REIT's Portfolio Maintains a Trend of Improvement |

| Feb 23, 2023 19:00 HKT/SGT |

|

Hektar REIT Realised Net Income higher by 187% for FY2022 |

| Feb 4, 2023 18:00 HKT/SGT |

|

Subang Parade Celebrates CNY with Persatuan Rumah K.I.D.S and Rumah Charis |

| Nov 29, 2022 18:00 HKT/SGT |

|

Hektar REIT's ESG Commitment Rewarded with Two Awards |

| More news >> |

|

|

|

|